Yes, there is a tax credit offered on the purchase of an e-bike by some state governments, but not from the federal government. I know there has been a buzz around the tax credit scheme on ebikes for the past 3 years and still no information regarding this legislation.

Why Government Thought to Introduce this Act?

In order to promote environment-friendly transportation all over the US. As it will reduce greenhouse gas emissions. This proposal will make e-bikes more pocket-friendly and potential buyers will buy it with more interest. It will save time and reduce traffic congestion on the roads. The government proposed this act with good intentions but don’t what happened it didn’t approve yet.

Federal Tax Credit Proposal for E-Bikes

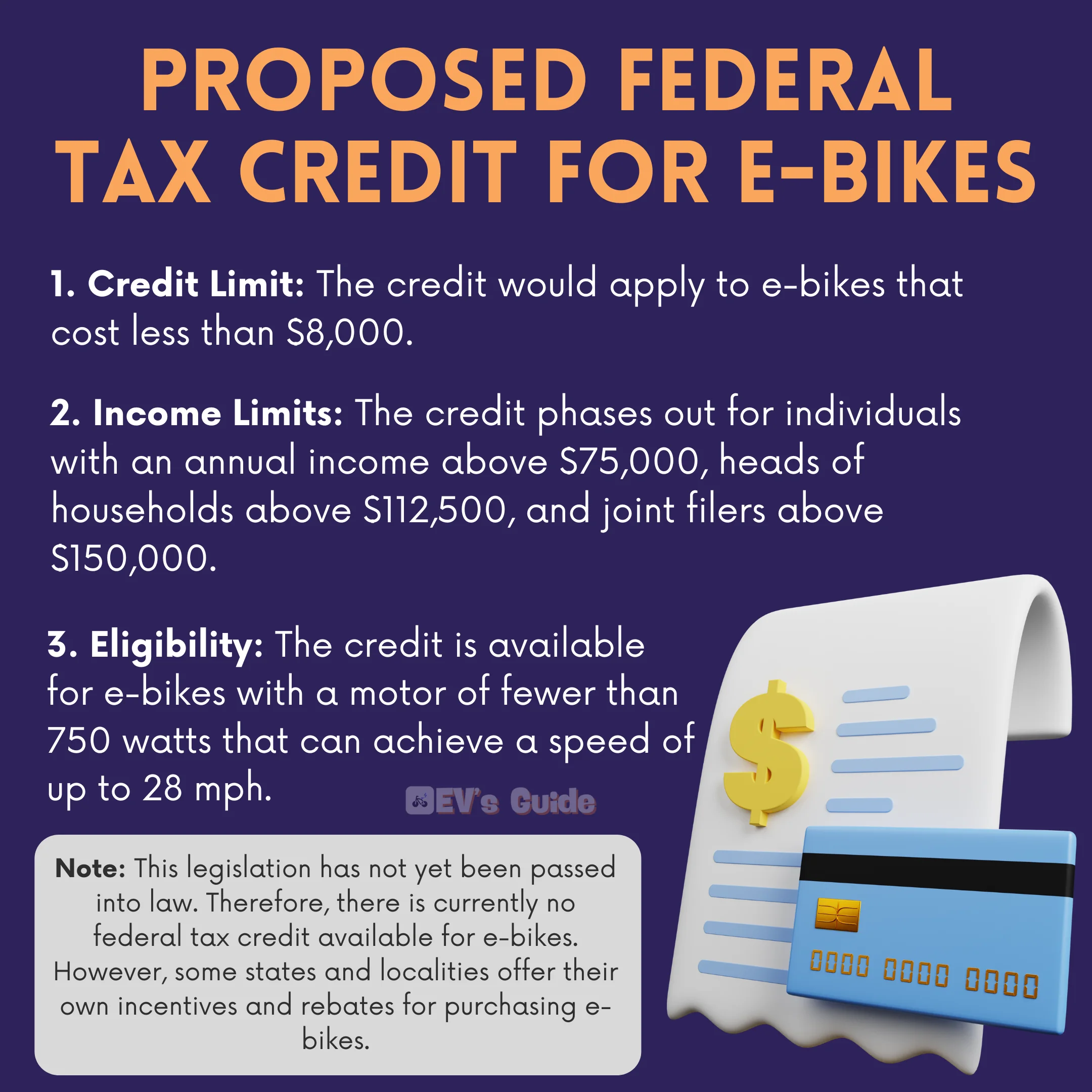

In 2021, there is a proposed federal tax credit for e-bikes in the United States under the Electric Bicycle Incentive Kickstart for the Environment (E-BIKE) Act. The bill aims to provide a tax credit on the purchase of new e-bikes. Here are some key points:

- Credit Limit: The credit would apply to e-bikes that cost less than $8,000 and the maximum rebate you can get is $1500.

- Income Limits: If you’re an individual with an annual income above $75,000, heads of households above $112,500, and joint filers above $150,000. The more you earn less credit you will receive. This is what stated in the proposal.

- Eligibility: Class 1, 2 & 3 are qualified.

How to stay informed?

I can totally understand the curiosity to avail of the tax rebate on the e-bikes and for that, you need to stay up to date. But how?

- Do follow/subscribe to our blog: Whenever we will receive updates on this topic we will keep on updating so, have an eye on this.

- Monitor Official Website: Keep an eye on the progress of the E-BIKE Act through reliable news sources or the official Congress website.

- Consult a Tax Professional: They are the ones who always stay up to date with the upcoming bills and passed laws.

U.S. States E-Bike Rebates & Tax Credits

Let’s see which state has to offer tax rebates on the purchase of an e-bike and how much credit they are offering.

California E-Bike Incentive Program

Fund for California e-bike incentive program has been approved for 2023. It is expected that this program is going to start at the end of June 2024. The rebate amount you can get is $750 for standard e-bikes and $1750 for cargo or adaptive e-bikes. An additional incentive of up to $250 for people whose income is under 225% or living in DAC (Disadvantaged Census).

This incentive program is based on first-come, first-serve. The government has allotted $5 million and approximately 15,000 bikes will get the voucher.

Eligible Criteria:

- Class 1, class 2 & class 3 e-bikes are qualified.

- Must be 18 years old & resident of California.

- Participants must purchase a bike from a retail store in California or the e-bike company must be from California.

- Participants’ income is capped at 300% of the federal poverty level (FPL), with special priority given to those under 225% FPL or living in a disadvantaged community.

- No limit on the number of vouchers an individual can get.

For more details, visit – California E-Bike Incentive Project

Colorado Statewide Electric Bicycle Tax Credit

Colorado was the first ever state in the US who started giving tax credits on the purchase of e-bikes. In 2023, the proposal became law and was implemented on 1st April 2024 created by HB23-1272.

All Colorado residents receive a $450 discount on e-bike purchases from participating retailers & participating retailers get $50 per qualifying e-bike sale. In their official press release, they mentioned a list of retail stores that have participated in this incentive program. This tax rebate program will run till 2032.

For more details, visit the Colorado Energy Office press release.

Connecticut E-Bike Incentive Program

Connecticut has a statewide program that was introduced on June 23, 2023 and the CT Government has allotted $500,000 per year in total $1.5 million has been reserved for this program and it will run it for 3 three years.

Eligible Criteria:

- Class 1, class 2 & class 3 e-bikes are qualified.

- Cycle should be new and purchased from a participating e-bike retail store.

- Retail MSRP must be under $3000 otherwise you won’t be eligible.

- There should be a warranty of 1 year at least.

- Have a household income that is less than 300% of the Federal Poverty Level.

Important Things to Note:

- Applicant must retain ownership of the eBike for a minimum of 24 months from the date of purchase.

- Connecticut resident is limited to 1 voucher.

For more details, visit the Electric Bicycles Incentive Program

Hawaii Electric Bike and Moped Rebate

The Hawaii rebate program started on 28 Feb 2023. The state has some restrictive program criteria as compared to other states. What are they?

1. Class 1, class 2 & class 3 e-bikes are qualified and moped with a speed limit of 28mph max.

2. Purchase must be made at a retail store on or after July 2, 2022.

3. The rebate amount is set up to $500 or 20% of the MSRP whichever is lower.

4. Resident can only receive a total of $500 in a fiscal year.

5. Applicant must be 18 years or old and should prove any of the following:

- Participation in a low-income assistance program such as the Supplemental Nutrition Assistance Program or Section 8

- Do not own a motor vehicle with four or more wheels

- Current enrollment in a school, college, or university

For more details, visit the Department of Transportation

Texas E-Bike Rebates

Austin: Only Austin has the rebate program in the whole Texas, it’s not a statewide program. The incentive range has been set by the state government.

Incentive Guidelines for Individual E-Ride Rebates

| E-Ride Purchase Price Range (Including tax) | 2023 Incentive |

| Up to $499 | NA |

| $500 – $999 | $200 |

| $1,000 – $1,999 | $400 |

| $2,000 and up | $600 |

Incentive Guidelines for Fleet Rebates

| E-Ride Purchase Price Range (Including tax) | 2023 Incentive |

| Up to $499 | NA |

| $500 – $999 | $400 |

| $1,000 – $1,999 | $600 |

| Over $2,000 | $800 |

Rebate application must be submitted under 60 days of purchase. Incentive got effective from January 1, 2023

For more details, visit the Austin energy

Rhode Island Electric Bicycle Rebate Program

Rhode Island e-bike rebate program was introduced in 24, october 2022 and it has a rebate of $1000 or 75% of the purchase of the bike for low-income households and for higher income it is $400 or 30%. All classes of e-bikes are eligible. There was $250,000 set aside for this program and the bike must be purchased in Rhode Island.

For more details, visit the drive.ri.gov

Vermont E-Bike Incentives

Vermont introduced the program in 2022, it was a rebate of $400. They didn’t specify the classes the of e-bikes, they just said that bike has to be new and 750W or less. Unfortunately, they put in $50k of funding and they are currently on hold because the funds are all gone.

List of States that are Planning on E-Bike Incentives

Massachusetts

According to reports, the Massachusetts government was going to implement this program in 2023 but still not been implemented (2024). Rebates were between $500 and $750 for both class 1&2 e-bikes, class 3 is excluded. The amount of the rebates depends on the income and they have set aside a budget of $1 million.

Tennessee

Tennesse Nashville considering an e-bike program that will cover anywhere from $300 all the way upto $1400.

New York

There is a bill in the works now that doesn’t mean that is actually going to pass but there is a chance. If the bill passes it will cover 50% or $1100 whichever is lower on the purchase of the ebike. One thing that is odd with this one is it covers all the class 1, 2 & 3 e-bikes but that is per New York law which based on what I read has lower speed limits than other states.

Oklahoma

This state does have a bill SB435 that if passed, would introduce a $200 tax credit not as good as some of the other programs that we have seen but it’s ok, at least this state has something to offer.

How to Claim Tax Credit on E-Bike

As you know there is no Federal Tax Credit on ebike so, there is no way to claim tax. And if we talk about the states that are offering rebates on e-bikes their official website links have been shared, where it has written how to apply and claim rebates on e-bike purchases.

FAQs

Q1. What is E-BIKE Act?

Ans. E-Bike Act stands for Electric Bicycle Incentive Kickstart for the Environment. In the E-BIKE Act, the federal government has designed this bill to encourage people to buy electric vehicles and get financial rebates. If the act is passed, the federal would offer 30% or $1500 credits on the purchase of an e-bike, whichever is the lower, $1500 is the maximum limit that you can get. It applies to the $8000 e-bikes above that you won’t get. Class 1, 2 & 3 e-bikes are qualified for this rebate. Plus, there is an income limit as well.

Q2. What is the Current Status of Legislation?

Ans. As of 2024, the bill has not passed yet and it’s likely to pass when a new government is formed after general elections. As it goes through the legislative process which includes both houses, it’s a lengthy process as it involves representatives from both houses and at last signed by the president to become a law.

Q3. Are there Any State or Local Incentives for E-Bikes?

Ans. Yes, some state and local incentives exist for e-bikes from California, Colorado, Connecticut, Hawaii, Austin, Rhode Island & Vermont.

Final Words

Well, there is nothing much to conclude from this article, as this article is a conclusion itself. I mean this article was main motive is to provide authentic news on E-Bike Tax Rebates and answer some of the highly-asked questions. If you have any questions in your mind you can definitely write it in the comment section & I will answer it in the next 24 hours.

I hope you found this blog post informative from other articles and cleared all your doubts.